What is planned?

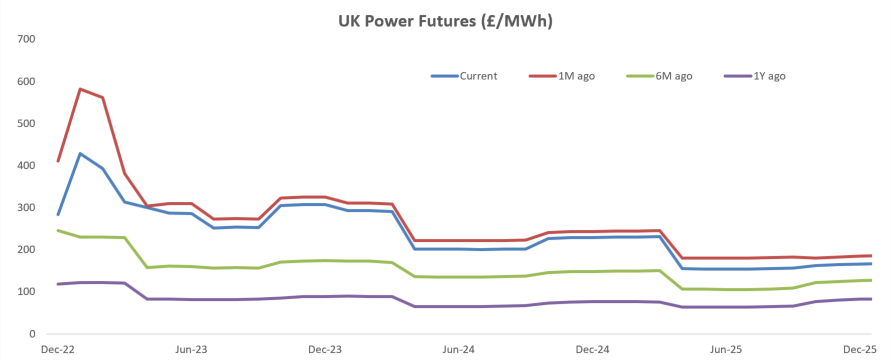

In December 2022, The UK Government is proposing to bring forward legislation for a new levy on UK electricity groups generating more than 100 Gigawatt-hours (GWh) per annum. The idea is to subject “Exceptional Generation Receipts” to a new 45 percent levy which importantly will not be deductible from profits subject to UK corporation tax. The levy will operate between January 2023 and March 2028.

The UK Treasury recently published their proposed calculation of the levy in their technical note. This calculation is as follows:

| £m | |

| Generation Receipts | XX |

| Less £75m* UK generation in Megawatt-hours (MWh) | (XX) |

| Less a Group threshold allowance | (10) |

| Receipts subject to Levy at 45% | XX |

What is the problem?

As is common with hastily considered tax measures, the devil is always in the detail and there are usually unintended consequences. The consequences that we see in this instance are:

1. The Levy was sold in the press as a windfall tax. Unfortunately, it is not – it is a tax on a proportion of revenues not profits.

As a result, the measure risks taxing groups that have properly incurred costs which are subsequently not being offset in the calculation of the levy. By example, those generating electricity to offset usage within their groups need to create formal intercompany contracts rather than selling to the market as a hedge. Failure to do so risks incurring the levy with no offset on the market price paid by another part of the group. As prices rise, this lack of offset becomes punitive, particularly as the levy is not off settable for corporation tax.

2. The Levy risks distorting the market for renewable generating assets with the thresholds being introduced.

Whilst we think the allowances and generation volume thresholds are sensible to avoid bringing too many companies into the levy regime, there is a risk of market distortion as a result. The size, scope and post-tax nature of the levy, together with near term forward prices means that the levy will have a material valuation impact for some but not all current and prospective owners. Those groups with limited current generation will have a significant competitive advantage over the larger generator groups.

What is next?

The proposals are being drafted into law and will be available for view next month (December 2022) ahead of the levy being introduced in January 2023. Whilst we hope that some of the unintended consequences will be ironed out, we think it is unlikely that all of the issues will be addressed given the rushed timeframes.

If you have any questions please contact Geoff Knight, Managing Director – Centrus

Back to Insights

Back to Insights